The financial sector has been extraordinarily weak over the past year. If you had anticipated the problems you could have offset some of the risk of the financial sector in your asset allocation. For example, the first plot above shows the equity curve for a 9% allocation to the Proshares Ultra Short Financials ETF (SKF) and a 91% allocation to SPY. The SKF would have approximately canceled out the financial sector from SPY. (SKF is a double short fund.)

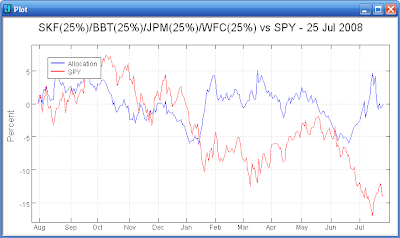

If your asset allocation uses individual stocks, you might have attempted to identify a few of the stronger financial stocks one year ago. You could have purchased them and then also purchased SKF to offset the risk of a disaster in the financials. The second plot above shows the equity curve for an allocation consisting of 25% each of BBT, JPM, WFC, and SKF.

The double short sector funds allow the asset allocator to tune exposure to sectors without having to sell existing positions. The double short funds might be used in a short/intermediate term trading overlay as a complement to your long term allocation strategy.

No comments:

Post a Comment