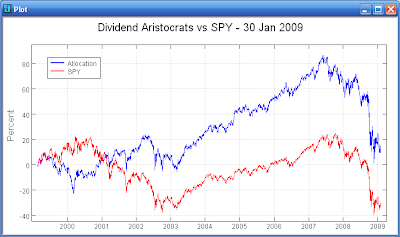

The Dividend Aristocrats are maintaining a small advantage over the S&P 500, but the defensive stocks have certainly not done well the past couple of years. Take a look at the first plot above which compares SPY to the Dividend Aristocrats.

The Low Beta/Low R-squared type of stocks have not out performed the general market in the current bear market. The second plot above shows the massive out performance of the Dividend Aristocrats in the 2000-2003 bear market. The destruction of the financial stocks has made this bear market quite different than the prior bear market.