The Shannon Method of rapid rebalancing (see prior post) has some potential to capture some of the random fluctuations in stock prices. I have pursued combining a small number of relatively uncorrelated stocks in a portfolio and rebalancing them as they move 3% from the prior rebalance point.

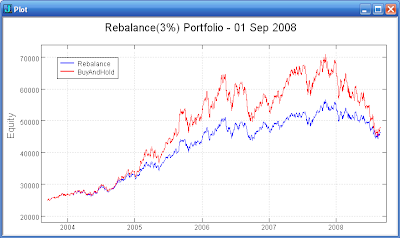

The plot above shows the results for a portfolio starting with four stocks (GG, MSFT, O, VLO) weighted 20% each and a 20% cash position. As the stocks surge up the rebalanced portfolio lags, but the buy-and-hold portfolio dropped much faster during the recent market reversal. The rebalancing produces a smoother return. Also note that the buy-and-hold portfolio holds $5,000 cash across the entire test period while the cash in the rebalanced portfolio has increased from $5,000 to $15,000 at the end of the test period.

More work will be need to evaluate the potential of this approach. A similar approach that I came across recently is the REAP method. This method utilizes small groups of stocks (6) that are rebalanced on an every 4 months basis. The longer time period rebalancing and the utilization of multiple independent 'six-packs' is intriguing and I will investigate this concept further.

No comments:

Post a Comment