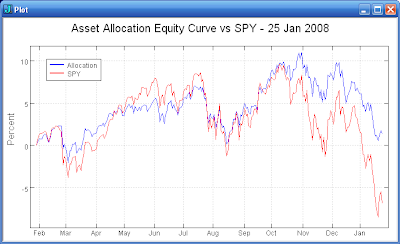

Even a simple asset allocation strategy can provide some relief during big market selloffs. For example, the plot above shows the results for SPY and a simple 60/40 allocation over the last year. The allocation consists of 15% SPY, 15% IWM, 20% EFA, 10% EEM, 30% IEF, and 10% SHY. The components represent the asset selection that is available in rudimentary retirement plans.

Are your long term accounts diversified? Have you examined a Monte Carlo simulation of your current allocation? Will you survive?

No comments:

Post a Comment