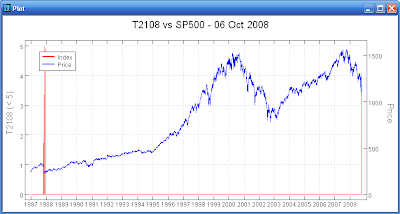

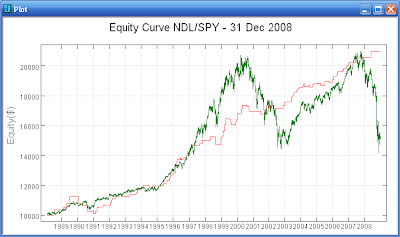

Buying the market at N-day lows and holding until a close above the N-day moving average can be a profitable approach. Take a look at the plot above. The plot shows the equity curve for buying SPY at 10 day lows. The method has a win rate of 81% with an average return of 0.8% per trade. There can be long painful waits for the market to rebound above the 10 day moving average as have occurred during recent market crashes. However, this approach appears to be a solid performer and may be suitable to form a portion of a mechanical trading system.