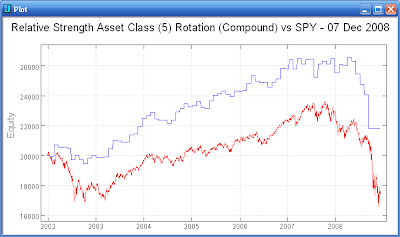

My September and August 'Asset Class Rotation' posts described a simple rotation scheme that buys the top 3 of 5 asset classes each month. The asset classes used were US Stocks, foreign stocks, US REITS, US Bonds, and commodities. The October/November market crash has taken its toll on the equity curve (shown above). However, the rotation scheme did reduce the amount lost. Should any asset allocation scheme include a method to reduce exposure and then increase exposure later?

No comments:

Post a Comment