Are the large stable 'boring' stocks the way to go? The SP-500 Dividend Aristocrats have increased their dividends each year for at least the last 25 years.

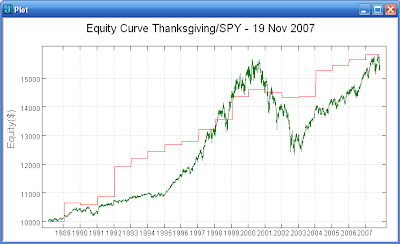

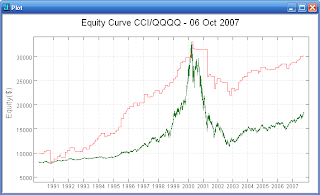

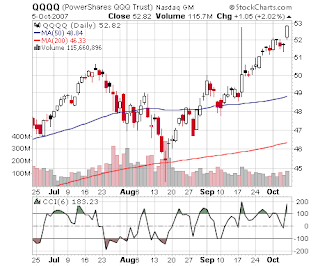

The first plot above shows the equity curve for the current batch of Dividend Aristocrats versus SPY for the last eight years. The Aristocrats significantly lagged during the tech surge of 1999-2000, but substantially outperformed during the tech collapse of 2000-2002. From 2003-2007, the Aristocrats have kept pace with SPY. However, the Aristocrats have been lagging SPY for the last 9 months. See the second plot above which covers the last three years. The financial sector Aristocrats have been faltering during this period.

For long term purposes, the Aristocrats would seem to be good choices for your large capitalization stock allocation. They also tend to have modest correlation to the SP-500 as a whole and can provide some diversity to your portfolio.

You can find an Excel spreadsheet listing the September 2007 members of the Dividend Aristocrats in the 12/28/2007 post at CrossingWallStreet.com.