Thursday, August 27, 2009

Sunday, August 23, 2009

Update: 3x2 System / Crash System

The variant of the StockPickr 'Crash System' that I follow has just moved up to a new equity high.

The variant of the StockPickr '3x2 System' that I follow has noticeably broken out to new equity highs since the last update in July.

Wednesday, August 19, 2009

Sunday, August 9, 2009

Trend: Near Perfect Straightness

Saturday, August 8, 2009

Dividend Aristocrats / Low Beta Low R-Squared

The 'Dividend Aristocrats' and Low Beta/Low R-Squared stocks in general have just not been of much advantage over the last year. The first plot above shows the performance of the Dividend Aristocrats over the past year compared with the performance of SPY. The Aristocrats have shown an advantage that was sometimes significant. The second plot above compares the set of 20 low beta/low R-Squared stocks that I follow. This set of stocks has demonstrated very little advantage over SPY. The high correlation of everything during the crash rendered most diversification schemes value free.

Sunday, August 2, 2009

Used Car Prices Up

The Manheim used car price index continues up. Has the value of the index as an indicator been reduced due to the various auto stimulus plans? Is the index indicating that the collapse of the economy has stopped? The current auto stimulus plans are moving future demand for cars to the present. Car sales may slow significantly after the government subsidies expire.

Saturday, August 1, 2009

Health Care

Will the health care reform schemes affect your portfolio?

The "Logan's Run" approach might allow big savings in health care expenditures.

The "Soylent Green" approach is another way to go. Remember, Tuesday is Soylent Green day.

The "Logan's Run" approach might allow big savings in health care expenditures.

The "Soylent Green" approach is another way to go. Remember, Tuesday is Soylent Green day.

Monday, July 27, 2009

Sunday, July 26, 2009

Trendiness Extreme

The 15 day trendiness has reached an extreme level. (See the plot above.) It is now over 0.9 (horizontal gray line). There will likely be some interruption of the straight line move up in the near future. In late February/early March 2009, the trendiness stayed elevated as the market collapsed. Are we in an equivalent panic period or will we quickly see a counter trend move?

I remember reading something that made a reference to the three week time period as being significant in terms of the human mind accepting a change. I believe that it was related to plastic surgery. Anyone know of the paper referenced, or the three week period as being significant in human psychology?

Tuesday, July 21, 2009

Monday, July 20, 2009

QQQQs Up 9 Days in a Row

The QQQQs have been up nine days in a row. What happens after the QQQQs have been up eight or more days in a row? The chart above summarizes the results for purchasing at the close and holding for one, two, five, and ten days after purchase. The results are good for a two, five, and ten day holding period. The results for a single day hold are not good. We may be looking at short term weakness followed by a further continuation of the rally.

Sunday, July 19, 2009

Indecision

Saturday, July 11, 2009

Update: 3x2 System / Crash System

The '3x2 System' is still holding near its high water mark of the last two years.

The 'Crash System' equity curve has also moved up nicely and is closing in on its highs.

A diversified portfolio of active trading methods certainly looks to be the way to go. However, the massive drawdown of these two methods during the crash of late 2008 suggests that some sort of disaster filter is needed.

Friday, July 10, 2009

Fear

Sunday, June 28, 2009

Set Realistic Goals

Obama Drastically Scales Back Goals For America After Visiting Denny's

Make sure your trading goals are realistic for your experience level, skill level, and available capital.

Saturday, June 27, 2009

The New Normal?

The statistics for the broad market indices (daily data) have become stationary for the past year. The plot of SPY above shows the stationarity for a rolling one year, two year, and three year period. When the colored lines are below the critical value (horizontal gray line), the statistics for the corresponding period are stationary. The statistics for the past two years and three years are not stationary. The past year has become the new normal. Will the coming year exhibit the same tendency for monster moves as the last year?

The more volatile emerging markets (EEM) also have stationary statistics for the past year. The statistics for the last two years and three years are not stationary, but are closer to the threshold than SPY. Will emerging markets continue to lead the way?

The long term treasury bonds (TLT) statistics are not stationary for the past one, two, or three year periods. TLT was even more destabilized by the October 2008 market crash than the stock indices. Can there be an economic recovery with instability in the bond markets?

Sunday, June 21, 2009

Shannon Rebalancing Revisited

What if we were to apply the Shannon method to the Permanent Portfolio discussed last week? The Permanent Portfolio used for testing was equal parts of VTI, TLT, SHY, and GLD. The plot above shows the results for the last three years for buy and hold and for Shannon style rebalancing. The rebalancing has helped a little bit since March 2009.

If we add a short SP-500 position (SDS) to the asset mix, the results are of course better as the market has had a rough couple of years. But, notice how much better the Shannon style rebalancing has done compared to buy and hold. This plot above shows the results for the last three years for a portfolio consisting of equal parts TLT, SHY, GLD, and SDS and a double allocation to VTI. Perhaps active rebalancing between an index and a short position in another index is what is need in uncertain times?

The correlations of the portfolio components are listed in the table above. Are there any asset classes that have a negative correlation to the stock market other than bond funds and short funds?

Crisis is Not Over

Deflation is a very real threat.

The mortgage delinquency problem still exists.

TrimTabs says go short.

There is always 2012 (video above).

Sunday, June 14, 2009

Update: Long Term Investment Portfolio

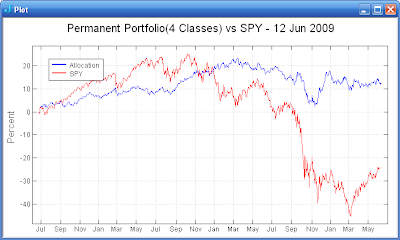

A correction from the prior post -- The original version of the Permanent Portfolio does use just four asset classes (stocks, bonds, gold, cash). The performance for the last three years using equal positions of TLT, SHY, GLD, and VTI is show above. The portfolio works because of the relatively low correlation between the asset classes. (See the table below.)

The Permanent Portfolio Fund (PRPFX) adds four more asset classes to the portfolio (silver, real estate, natural resource stocks, and Swiss Franc). The correlations for eight ETFs representing these asset classes is show in the table above. The additional asset classes do add much in the way of reduced correlation.

The additional asset classes do not modify the performance over the last three years by a large amount. The plot above shows the equity curve for the portfolio using the following ETFs and weightings: TLT/18%, SHY/17%, GLD/20%, SLV/5%, IWM/15%, ICF/8%, IGE/7%, and FXF/10%. The extra asset classes seem to have increased the variability of the portfolio a bit. Addition study will be required to determine if the additional asset classes (implemented with ETFs) are really worthwhile additions to the four class portfolio.

Sunday, June 7, 2009

Long Term Investment Portfolio

What should the composition be of a really long term portfolio? Such a portfolio must be capable of surviving through inflation, deflation, recession, and good times. The Permanent Portfolio, originally proposed by Harry Browne, may be such a portfolio.

A variant of the Permanent Portfolio proposed by CrawlingRoad is even simpler. It consists of long term treasuries, short term treasuries, gold bullion, and US total stock market index. The compound annual growth rate (CAGR) for the Permanent Portfolio from 1972-2008 was 9.79%. The plot above shows the portfolio compared to SPY for the last 3.5 years. The portfolio in the plot above consists of 25% positions in each of TLT, SHY, GLD, and VTI.

The CAGR for the Permanent Portfolio is a bit better than the total stock market index while greatly reducing the devastating drawdowns of the stock market alone. The original Permanent Portfolio also included an allocation to silver, real estate, natural resource stocks, and the Swiss franc. I will more closely examine the original portfolio. Either version of the Permanent Portfolio may be a good approach for the long term core position allocation of your personal portfolio.

Saturday, June 6, 2009

Soldier of Fortune

Can you rent a trading method from someone else and be successful? Suppose you subscribe to a proprietary trading signal, will you have sufficient confidence in the methodology to follow the signals? Some of the subscription services certainly have good records. If your own methodology can not match the reliability/return/statistics of the following services, would you be better off renting a methodology from one of these services?

Vertical Solutions: S&P 500 futures $250/month

MarketSci: YK Strategy - S&P 500 and Russell 2000 $100/Month

QuantifiableEdges: Variety of Analysis and Trade setups $75/month

Sunday, May 31, 2009

Update: Asset Class Rotation

In a post back in August 2008, I examined the results for a simple relative strength asset class rotation scheme. The approach buys the top N of M asset classes each month.

The plot above shows the results for the last 4 1/2 years for buying the top 5 of 8 asset classes each month. The return was better than SPY. The asset classes in this case were actual ETFs (AGG, EEM, EFA, IWM, IYR, SPY, and TIP) and one commodity index (DJAIG).

The results were significantly better by just buying the top 3 of 8 asset classes. The plot above shows the results over the past 4 1/2 years using the same set of asset classes.

While there was a big drawdown during the market crash, an active approach to asset class allocation would seem to be a good approach to helping to smooth out returns during turbulent market periods.

The plot above shows the results for the last 4 1/2 years for buying the top 5 of 8 asset classes each month. The return was better than SPY. The asset classes in this case were actual ETFs (AGG, EEM, EFA, IWM, IYR, SPY, and TIP) and one commodity index (DJAIG).

The results were significantly better by just buying the top 3 of 8 asset classes. The plot above shows the results over the past 4 1/2 years using the same set of asset classes.

While there was a big drawdown during the market crash, an active approach to asset class allocation would seem to be a good approach to helping to smooth out returns during turbulent market periods.

Saturday, May 30, 2009

Update: 3x2 System and Crash System

The '3x2 System' has continued making a nice recovery. The equity curve is at the highs of mid-2008.

The 'Crash System' has been moving up and is closing on the highs.

The two systems have complemented each other relatively well over the past few months. A diversified portfolio of active trading methods may be the best approach for the uncertain future.

Monday, May 25, 2009

Diversification

What about diversification into casino gambling? I realize that craps has a negative expectancy, but the house edge on the pass line bet is only 1.41%. One advantage of casino games over the stock market is that you actually know the probability of the various outcomes and the statistics are stationary. Perhaps we can learn something about money management from analyzing casino games?

Take a look above at a typical equity curve for a pass line craps bet. (You of course do not always make a profit for every 1000 trials.) The run lengths of winning and losing (negative run length) bets for the same 1000 trials is also shown above. We can see that you typically do not lose more three times in a row. We can double the amount of the wager after we have lost three in a row and continue with the larger wager until we win. This gives you a good shot at a successful trip to the casino.

I will have to look further into quantifying the apparent improvement in performance by increasing the wager after three losses in a row. Perhaps additional mild progression may be the way to increase the frequency of successful trips to the casino?

Sunday, May 24, 2009

Dividend Aristocrats -- Not Good

The low beta/low R-squared stocks like the 'Dividend Aristocrats' have not showed much advantage over the market in the last two years. See the plot above. They have shown a small advantage over the market (SPY) since the crash during the Fall of 2008. The devastation of the financial sector has caused many of the Aristocrats to lose their place on the list.

Sunday, May 17, 2009

Red Power

Sunday, May 10, 2009

Long Term Rates Move Higher

Saturday, May 9, 2009

Banks?

Are the banks really what they pretend to be?

The weekly failures continue.

How stressful was the stress test.

Banks looking to sell billions of shares of common stock while the price is up.

Has hope reached its limits?

<o>

Sunday, May 3, 2009

Saturday, May 2, 2009

Time Trading

Trading just based on seasonal tendencies is an yet another trading method to examine. The plot above shows the equity curve for a system that is always in the market either long or short. The trades are entered and exited based only on the date. It works fairly well. Over the last 10 years it has done much better than buy and hold. However, the method did poorly in 2006 and 2007 as the market surged higher. But, it caught the big market crash of late 2008.

Sunday, April 26, 2009

ShamWow ?

What to do about about long term investment? The first plot above marks 10% percent moves up or down in SPY since the prior marked point. Have all of the dire economic problems disappeared in the last few months or are we merely in a lull before the next round of panic? The second plot above marks 20% moves up or down in VIX since the prior marked point. The volatility and level of the VIX have continued to drop since the crash last fall. Can the market continue to hold 20 times its own weight in uncertainty and bad debt?

Monday, April 20, 2009

Update: Market Neutral

QQQQ continues to outperform SPY. Market neutral positions can have advantages during volatile uncertain market periods. The QQQQ/SPY spread has improved since the last update.

SLV has pulled back to the -2 standard deviations point. Can it recover and again outperform GLD?

Sunday, April 19, 2009

Update: 3x2 System and Crash System

The '3x2 System' has been making a nice recovery in the last two months. The equity curve is within striking distance of the mid-2008 highs.

The 'Crash System' moved down a bit in the last two months after a spectacular recovery since late 2008.

The two systems have complemented each other relatively well over the past few months. A diversified portfolio of active trading methods may be the best approach for the uncertain future.

Subscribe to:

Comments (Atom)