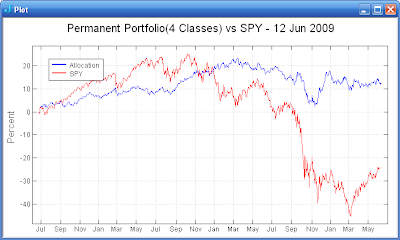

A correction from the prior post -- The original version of the Permanent Portfolio does use just four asset classes (stocks, bonds, gold, cash). The performance for the last three years using equal positions of TLT, SHY, GLD, and VTI is show above. The portfolio works because of the relatively low correlation between the asset classes. (See the table below.)

The Permanent Portfolio Fund (PRPFX) adds four more asset classes to the portfolio (silver, real estate, natural resource stocks, and Swiss Franc). The correlations for eight ETFs representing these asset classes is show in the table above. The additional asset classes do add much in the way of reduced correlation.

The additional asset classes do not modify the performance over the last three years by a large amount. The plot above shows the equity curve for the portfolio using the following ETFs and weightings: TLT/18%, SHY/17%, GLD/20%, SLV/5%, IWM/15%, ICF/8%, IGE/7%, and FXF/10%. The extra asset classes seem to have increased the variability of the portfolio a bit. Addition study will be required to determine if the additional asset classes (implemented with ETFs) are really worthwhile additions to the four class portfolio.

No comments:

Post a Comment