A short period Commodity Channel Index (CCI) can be used as a good intermediate term timing tool.

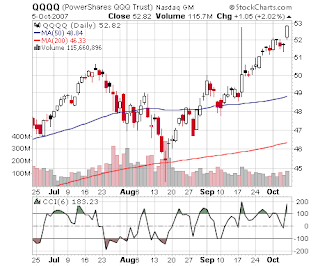

BZBTrader had a post a couple of weeks ago that shows good test results using a six period (end of day) CCI applied to the QQQQs.

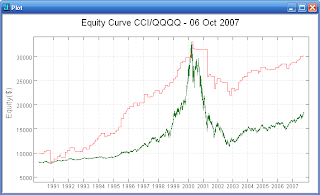

BZBTrader discloses the method and provides test output from Trade Station with 'Pyramiding' turned on. The first plot above shows my recreation of the testing on a 'Single Contract' basis. The results are statistically significant and the average win size is large enough to cover expenses. The drawdown can be significant. However, the short trades considered by themselves are not statistically significant and the average win size is very small.

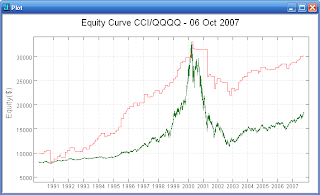

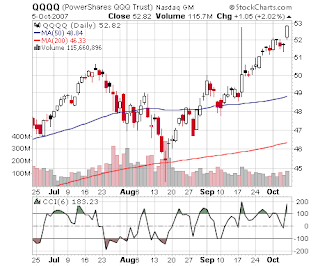

If we test across the entire 17 year history of the QQQQs we see the test results deteriorate to the point of becoming statistically insignificant. (I agree that the most recent several years performance is probably more important.) The equity curve for the entire history of the QQQQs is shown in the second plot above. If we test just the long trades across the entire history of the QQQQs we see that the results are statistically significant and the win size remains relatively large. The third plot above shows the equity curve for the long only trades. Note that the curve is much smoother without the short trades.

What can we conclude from this testing? It seems that the six day CCI can be used as a tool to help us with intermediate term timing. The results for the short only trades are not good. This makes the use of the method for timing short trades questionable. Many thanks to

BZBTrader for sharing the methodology! I will be looking further into incorporating the CCI into my trading tool box.